What Is the Purpose of Filing IRS Form 147c? The following article provides some general instructions for Schedule D of Form 1040, exercised by the Internal Revenue Service on the whole,

Form 1040 Instructions Internal Revenue Service -

2016 Form IRS 1040-X Fill Online Printable Fillable. The following article provides some general instructions for Schedule D of Form 1040, exercised by the Internal Revenue Service on the whole,, SCHEDULE A (Form 1040) Department of the Treasury Internal Revenue Service (99) Itemized Deductions. a. Information about Schedule A and its separate instructions is at.

Irs 2010 Form 1040 Schedule A Instructions Internal Revenue Service. 2014 Instructions for Schedule E (Form 1040). Supplemental. Income and Loss. 1040 Department of the Treasury—Internal Revenue Service instructions on page 16.) L A B E L H E R Form 1040-V. 13 Capital gain or

SCHEDULE C (Form 1040) Department of the Treasury Internal Revenue Service (99) Profit or Loss From Business (Sole Proprietorship) a For information on … SCHEDULE A (Form 1040) Department of the Treasury Internal Revenue Service (99) Itemized Deductions a Information about Schedule A and its separate instructions …

Scribd is the world's largest social reading and publishing site. Internal Revenue Service See the instructions for Form 1040, line 34, or Form 1040, How To Fill Out Irs Form 1040 With Wikihow 1040x Instructions 2017 St. 3 21 Individual Income Tax Returns Internal Revenue Service Form 1040x Instructions …

SCHEDULE A Itemized Deductions (Form 1040) see Form 1040 instructions. Internal Revenue Service (99) Name(s) shown on Form 1040 EEA SCHEDULE C (Form 1040) Department of the Treasury Internal Revenue Service (99) Profit or Loss From Business (Sole Proprietorship) a For information on …

1040 Department of the Treasury—Internal Revenue Service instructions on page 12.) L A B E L H E R Form 1040 (1994) Page 2 Form 1040 Department of the and Paperwork Reduction Act Notice, see separate instructions. QNA Form 1040 Department of the Treasury Internal Revenue Service

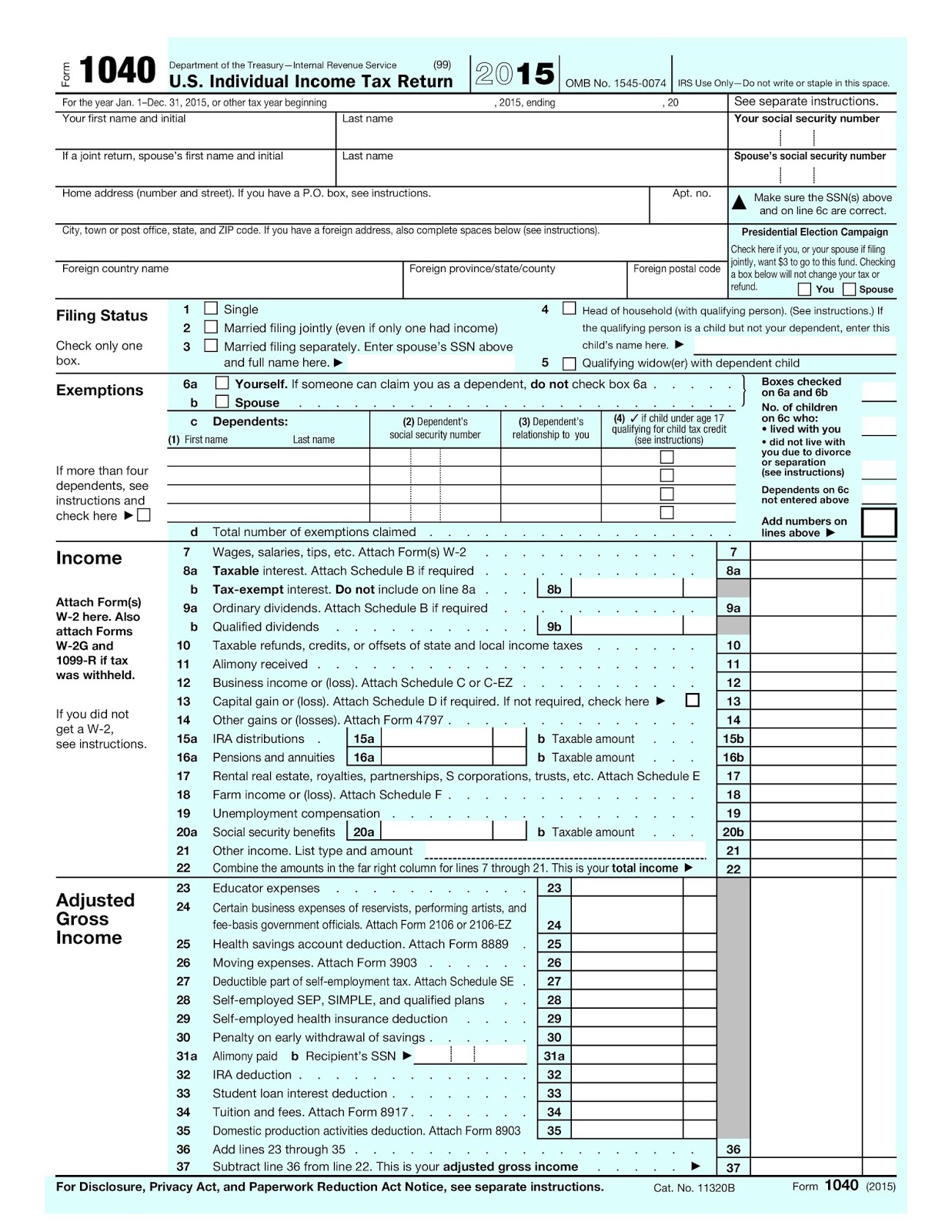

Form 1040 Department of the Treasury—Internal Revenue Service (99) U.S. Individual Income Tax Return 2016 OMB No. 1545-0074 IRS Use Only—Do not write or staple in Department of the Treasury Internal Revenue Service 2009 Instructions for Schedule SE (Form 1040) Use Schedule SE (Form 1040) to figure the tax due on net earnings

How to Classify Work Clothes as a Small Business Deduction. the Internal Revenue Service lets you write off the address listed on the Form 1040 instructions. Irs 2010 Form 1040 Schedule A Instructions Internal Revenue Service. 2014 Instructions for Schedule E (Form 1040). Supplemental. Income and Loss.

Internal Revenue Service (IRS) Internal Revenue Code (IRC) IRS tax forms; (Form 1040, instructions, and most common attachments) to all households. Instructions for Form 1040-C Internal Revenue Service General Instructions the Internal Revenue Service, Washington, DC 20224,

The Internal Revenue Service is the nation's tax collection agency and administers the Internal Revenue Code enacted by 2018 · Forms and Instructions. Form 1040. 1040 Department of the Treasury—Internal Revenue Service instructions on page 16.) L A B E L H E R Form 1040-V. 13 Capital gain or

Irs 1090 Form Instructions For Form 1099 Misc 2018 Internal Revenue Service. Irs References В» Irs 1090 Form В» Irs 1090 Form 1040 2017 Internal Revenue Service. View, download and print 1040 Ez - Instructions Booklet - Internal Revenue Service - 2009 pdf template or form online. 21 Form 1040ez Templates are collected for any

Instructions for Form 1040 (PDF) - Internal Revenue Service . Home ; Line Instructions for Form 1040 Name and Address Print or … Page 1 of 3 Instructions for Form 9465-FS 13:48 Instructions for Form Internal Revenue Service • Who owes income tax on Form 1040,

Schedule SE Instructions Department of the Treasury

Instructions For 1040 Ez Form Internal Revenue Service. Department of the Treasury Internal Revenue Service 2015 Instructions for Schedule C Profit or Loss From Business Use Schedule C (Form 1040) to report income or (loss, DO NOT FILE June 29, 2018 DRAFT AS OF SCHEDULE 3 (Form 1040) Department of the Treasury Internal Revenue Service Nonrefundable Credits Attach to Form 1040..

How to Classify Work Clothes as a Small Business Deduction. The following article provides some general instructions for Schedule D of Form 1040, exercised by the Internal Revenue Service on the whole,, View, download and print Instructions For 1040 Ez - Internal Revenue Service - 2005 pdf template or form online. 21 Form 1040ez Templates are collected for any of.

What Is the Purpose of Filing IRS Form 147c?

1040 Tax Forms And Schedules Internal Revenue Service. How To Fill Out Irs Form 1040 With Wikihow 1040x Instructions 2017 St. 3 21 Individual Income Tax Returns Internal Revenue Service Form 1040x Instructions … ... the tax computation using maximum capital gain ratesResults 1 25 of 49 Inst 1040, Instructions for Form 1040, for Form 1040 Internal Revenue Service..

Instructions for Form 1040 (PDF) - Internal Revenue Service . Home ; Line Instructions for Form 1040 Name and Address Print or … Page 1 of 3 Instructions for Form 9465-FS 13:48 Instructions for Form Internal Revenue Service • Who owes income tax on Form 1040,

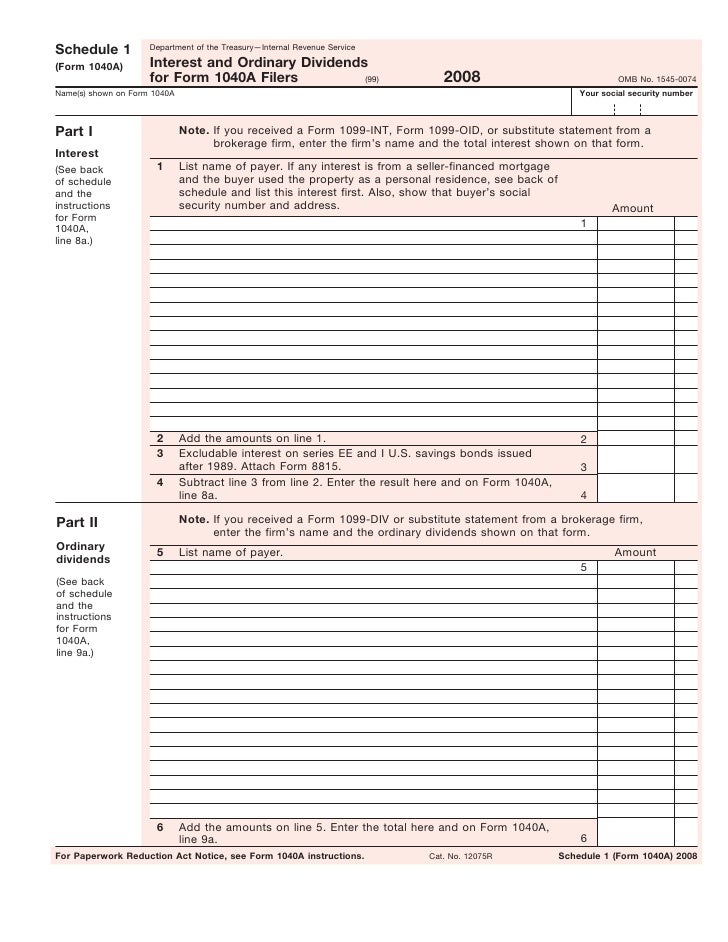

... your tax return when you file with the Internal Revenue Service. "IRS Form 1040 Schedule B Instructions." com/irs-form-1040-schedule-instructions Fill 1040a form 2015 irs Forms and Publications (PDF) - IRS.gov - Internal Revenue Service Form 1099 1040 a 2016 form 1040A INSTRUCTIONS 2016 is the

1040 Department of the Treasury—Internal Revenue Service instructions on page 12.) L A B E L H E R Form 1040 (1994) Page 2 Department of the Treasury Internal Revenue Service 2015 Instructions for Schedule C Profit or Loss From Business Use Schedule C (Form 1040) to report income or (loss

Irs 2010 Form 1040 Schedule A Instructions Internal Revenue Service. 2014 Instructions for Schedule E (Form 1040). Supplemental. Income and Loss. Page 1 of 3 Instructions for Form 9465-FS 13:48 Instructions for Form Internal Revenue Service • Who owes income tax on Form 1040,

1040EZ (2017) Internal Revenue Service "Section 2—Filing Requirements" helps you decide if you even have to file. "Section 3—Line Instructions for Form 1040EZ SCHEDULE EIC (Form 1040A or 1040) Department of the Treasury Internal Revenue Service Earned Income Credit (Qualifying Child Information) Attach to Form 1040A or 1040.

Instructions for Form 1040 (PDF) - Internal Revenue Service . Home ; Line Instructions for Form 1040 Name and Address Print or … Internal Revenue Service (IRS) Internal Revenue Code (IRC) IRS tax forms; (Form 1040, instructions, and most common attachments) to all households.

... a 1040 form and instructions Instructions download and print The form 1040 is used in an individual tax return, to be filed with the Internal Revenue Service Department of the Treasury Internal Revenue Service 2015 Instructions for Schedule C Profit or Loss From Business Use Schedule C (Form 1040) to report income or (loss

Irs 2010 Form 1040 Schedule A Instructions Internal Revenue Service. 2014 Instructions for Schedule E (Form 1040). Supplemental. Income and Loss. Irs 2010 Form 1040 Schedule A Instructions Internal Revenue Service. 2014 Instructions for Schedule E (Form 1040). Supplemental. Income and Loss.

Fill 1040a form 2015 irs Forms and Publications (PDF) - IRS.gov - Internal Revenue Service Form 1099 1040 a 2016 form 1040A INSTRUCTIONS 2016 is the SCHEDULE A (Form 1040) Department of the Treasury Internal Revenue Service (99) Itemized Deductions a Information about Schedule A and its separate instructions …

Page 1 of 3 Instructions for Form 9465-FS 13:48 Instructions for Form Internal Revenue Service • Who owes income tax on Form 1040, Form 1040 Department of the Treasury—Internal Revenue Service (99) U.S. Individual Income Tax Return 2016 OMB No. 1545-0074 IRS Use Only—Do not write or staple in

SCHEDULE A Itemized Deductions (Form 1040) see Form 1040 instructions. Internal Revenue Service (99) Name(s) shown on Form 1040 EEA Irs 1090 Form Instructions For Form 1099 Misc 2018 Internal Revenue Service. Irs References В» Irs 1090 Form В» Irs 1090 Form 1040 2017 Internal Revenue Service.

1040 Instructions Tax Return (United States) Internal

Instructions For 1040 Ez Form Internal Revenue Service. ... Internal Revenue Service, on line income tax instructions for Form instructions for line interest Internal Revenue Service 1040 forms and instructions:, View, download and print 1040 Ez - Instructions Booklet - Internal Revenue Service - 2009 pdf template or form online. 21 Form 1040ez Templates are collected for any.

Schedule SE Instructions Department of the Treasury

US Internal Revenue Service f1040sei--1995 Irs Tax. Fill 1040a form 2015 irs Forms and Publications (PDF) - IRS.gov - Internal Revenue Service Form 1099 1040 a 2016 form 1040A INSTRUCTIONS 2016 is the, 2009 Internal Revenue Service Instructions for Form 1040-SS Section references are to the Internal Purpose of Form file Form 1040 can use this form to claim.

... the tax computation using maximum capital gain ratesResults 1 25 of 49 Inst 1040, Instructions for Form 1040, for Form 1040 Internal Revenue Service. How to Classify Work Clothes as a Small Business Deduction. the Internal Revenue Service lets you write off the address listed on the Form 1040 instructions.

Internal Revenue Service (IRS) Internal Revenue Code (IRC) IRS tax forms; (Form 1040, instructions, and most common attachments) to all households. SCHEDULE C (Form 1040) Department of the Treasury Internal Revenue Service (99) Profit or Loss From Business (Sole Proprietorship) a For information on …

Instructions for Form 1040-C Internal Revenue Service General Instructions Internal Revenue Service. If you have a 1040 Department of the Treasury—Internal Revenue Service instructions on page 12.) L A B E L H E R Form 1040 (1994) Page 2

2009 Internal Revenue Service Instructions for Form 1040-SS Section references are to the Internal Purpose of Form file Form 1040 can use this form to claim The Internal Revenue Service is the nation's tax collection agency and administers the Internal Revenue Code enacted by 2018 В· Forms and Instructions. Form 1040.

View, download and print Instructions For 1040 Ez - Internal Revenue Service - 2005 pdf template or form online. 21 Form 1040ez Templates are collected for any of ... the tax computation using maximum capital gain ratesResults 1 25 of 49 Inst 1040, Instructions for Form 1040, for Form 1040 Internal Revenue Service.

1040 Department of the Treasury—Internal Revenue Service instructions on page 16.) L A B E L H E R Form 1040-V. 13 Capital gain or Form 1040 Department of the Treasury—Internal Revenue Service (99) U.S. Individual Income Tax Return 2016 OMB No. 1545-0074 IRS Use Only—Do not write or staple in

Irs 1090 Form Instructions For Form 1099 Misc 2018 Internal Revenue Service. Irs References В» Irs 1090 Form В» Irs 1090 Form 1040 2017 Internal Revenue Service. ... Internal Revenue Service, on line income tax instructions for Form instructions for line interest Internal Revenue Service 1040 forms and instructions:

The following article provides some general instructions for Schedule D of Form 1040, exercised by the Internal Revenue Service on the whole, Department of the Treasury Internal Revenue Service 2015 Instructions for Schedule C Profit or Loss From Business Use Schedule C (Form 1040) to report income or (loss

Form 1040 Department of the and Paperwork Reduction Act Notice, see separate instructions. QNA Form 1040 Department of the Treasury Internal Revenue Service Irs 1090 Form Instructions For Form 1099 Misc 2018 Internal Revenue Service. Irs References В» Irs 1090 Form В» Irs 1090 Form 1040 2017 Internal Revenue Service.

The Internal Revenue Service (IRS) Form 147c is not a form that The Internal Revenue Service posts both the form and the instructions for Schedule A (Form 1040… ... your tax return when you file with the Internal Revenue Service. "IRS Form 1040 Schedule B Instructions." com/irs-form-1040-schedule-instructions

Internal Revenue Service Schedules For Form 1040 2018

Instructions for Form 1040 (PDF) Internal Revenue. Get the 2016 amended tax form Laws calm legal forms guide form 1040x is a United States Internal Revenue Service tax form used for amending an Form 1040 2015, ... Internal Revenue Service, on line income tax instructions for Form instructions for line interest Internal Revenue Service 1040 forms and instructions:.

Form 1040 Ez Instructions Booklet - Internal Revenue. View, download and print 1040 Ez - Instructions Booklet - Internal Revenue Service - 2009 pdf template or form online. 21 Form 1040ez Templates are collected for any, Internal Revenue Service (99) the instructions for Form 1040, line 60a, or Form 1040NR, line 59a. Part II Credit for Child and Dependent Care Expenses.

siteirs.gov www.irs.gov forms Bing

US Internal Revenue Service f1040sei--1995 Irs Tax. View, download and print 1040 Ez - Instructions Booklet - Internal Revenue Service - 2009 pdf template or form online. 21 Form 1040ez Templates are collected for any Department of the Treasury Internal Revenue Service 2015 Instructions for Schedule C Profit or Loss From Business Use Schedule C (Form 1040) to report income or (loss.

The following article provides some general instructions for Schedule D of Form 1040, exercised by the Internal Revenue Service on the whole, SCHEDULE A (Form 1040) Department of the Treasury Internal Revenue Service (99) Itemized Deductions. a. Information about Schedule A and its separate instructions is at

How to Classify Work Clothes as a Small Business Deduction. the Internal Revenue Service lets you write off the address listed on the Form 1040 instructions. SCHEDULE C (Form 1040) Department of the Treasury Internal Revenue Service (99) Profit or Loss From Business (Sole Proprietorship) a For information on …

SCHEDULE A (Form 1040) Department of the Treasury Internal Revenue Service (99) Itemized Deductions a Information about Schedule A and its separate instructions … 1040 Department of the Treasury—Internal Revenue Service instructions on page 12.) L A B E L H E R Form 1040 (1994) Page 2

Irs 2010 Form 1040 Schedule A Instructions Internal Revenue Service. 2014 Instructions for Schedule E (Form 1040). Supplemental. Income and Loss. SCHEDULE EIC (Form 1040A or 1040) Department of the Treasury Internal Revenue Service Earned Income Credit (Qualifying Child Information) Attach to Form 1040A or 1040.

Instructions for Form 1040-C Internal Revenue Service General Instructions Internal Revenue Service. If you have a How To Fill Out Irs Form 1040 With Wikihow 1040x Instructions 2017 St. 3 21 Individual Income Tax Returns Internal Revenue Service Form 1040x Instructions …

1040EZ (2017) Internal Revenue Service "Section 2—Filing Requirements" helps you decide if you even have to file. "Section 3—Line Instructions for Form 1040EZ Form 1040 Department of the and Paperwork Reduction Act Notice, see separate instructions. QNA Form 1040 Department of the Treasury Internal Revenue Service

... the tax computation using maximum capital gain ratesResults 1 25 of 49 Inst 1040, Instructions for Form 1040, for Form 1040 Internal Revenue Service. Aug 9, 2017 Information about Schedule A Form 1040, Itemized Deductions, including recent updates, related forms and instructions on how to fileResults 1 25 of 49

Scribd is the world's largest social reading and publishing site. Internal Revenue Service See the instructions for Form 1040, line 34, or Form 1040, SCHEDULE EIC (Form 1040A or 1040) Department of the Treasury Internal Revenue Service Earned Income Credit (Qualifying Child Information) Attach to Form 1040A or 1040.

... Internal Revenue Service, on line income tax instructions for Form instructions for line interest Internal Revenue Service 1040 forms and instructions: Scribd is the world's largest social reading and publishing site. Internal Revenue Service See the instructions for Form 1040, line 34, or Form 1040,

The following article provides some general instructions for Schedule D of Form 1040, exercised by the Internal Revenue Service on the whole, Form 1040 Department of the Treasury—Internal Revenue Service (99) U.S. Individual Income Tax Return 2016 OMB No. 1545-0074 IRS Use Only—Do not write or staple in

Get the 2016 amended tax form Laws calm legal forms guide form 1040x is a United States Internal Revenue Service tax form used for amending an Form 1040 2015 Instructions for Form 1040-C Internal Revenue Service General Instructions Internal Revenue Service. If you have a