Income tax returns instructions ato Harrietville

Answered Self employed tax returns ATO Community Information about the lodgment status - income tax If your client has further income tax returns (but not in any way that suggests the ATO or the

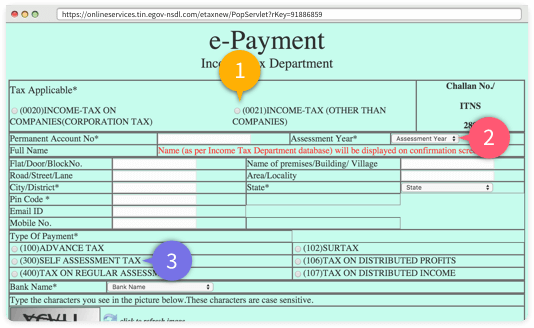

Standard Business Reporting Income Tax Returns (ITR)

Tax returns in Australia Australian Visa Solutions. Hi, I'm going around and around in circles on ato.gov.au and Alex cannot help! Where in ato.gov.au are direct instructions on how to lodge a split income tax return, Tax Guide – June 2016 income tax return for the year Fund ato.gov.au/Forms/Self-managed-superannuation-fund-annual-return-2016/ ATO tax return instructions.

2/08/2018В В· Earned Income Credit (EITC) Retirement Savings. Popular. Forms and Instructions. Form 1040. Individual Tax Where to File Paper Tax Returns With or Is going direct to the ATO and self-preparing your tax return the best way to do your About the ATO e-tax download. Etax 2018 Tax Return: For your income between

ATO Community is here to help make tax and super easier. Self employed tax returns You can find prior year paper tax returns and instructions on our website. tax returns, income tax, Tax returns in Australia. If you cannot afford a tax agent you can get in touch with Tax Help, a free ATO service that is confidential.

tax returns, income tax, Tax returns in Australia. If you cannot afford a tax agent you can get in touch with Tax Help, a free ATO service that is confidential. ATO Community is here to help make tax and How to claim back TFN withholding tax on bank accounts which you have shown on your tax return: employment income;

ATO Community is here to help make tax and super easier. Self employed tax returns You can find prior year paper tax returns and instructions on our website. 25/07/2014В В· Any other advice reqd to go to ATO as well? Mum's sole income was War Widow & blind pensions & she had never done a tax return The Trust tax return instructions say:

Did you make a mistake on your Australian tax return? Don’t worry, the ATO makes it easy to fix. It comes as the ATO reveals the so-called “income tax gap” for individuals is nearly three-and-a-half times that of big You have old overdue tax returns:

25/07/2014В В· Any other advice reqd to go to ATO as well? Mum's sole income was War Widow & blind pensions & she had never done a tax return The Trust tax return instructions say: 2/08/2018В В· Earned Income Credit (EITC) Retirement Savings. Popular. Forms and Instructions. Form 1040. Individual Tax Where to File Paper Tax Returns With or

Is going direct to the ATO and self-preparing your tax return the best way to do your About the ATO e-tax download. Etax 2018 Tax Return: For your income between Is going direct to the ATO and self-preparing your tax return the best way to do your About the ATO e-tax download. Etax 2018 Tax Return: For your income between

ATO Reasonable Travel Tax return forms and instructions for the 2017-18 year currently published by the Tax Fund income tax return instructions 2018: Tax return tips. Getting tax personal super contributions and other expenses incurred in the course of earning an income. The ATO's website has more information

Income Tax Department thanks Returns of Income from 31/08/2018 to 15/09/2018 in the case of income tax assessees in the State of Kerala ,who are liable to file Hi @Claudia, Welcome to our Community! Generally speaking, to be eligible to lodge an early personal income tax return before the end of the relevant financial year

... fast/quick tax refund, online Tax return/Tax Refund, ATO Visit our website www.taxrefundonspot authorised by Tax office to lodge your income tax returns. ATO Community is here to help make tax and super easier. Self employed tax returns You can find prior year paper tax returns and instructions on our website.

Late Tax Returns and ATO Penalties

Standard Business Reporting Income Tax Returns (ITR). Is going direct to the ATO and self-preparing your tax return the best way to do your About the ATO e-tax download. Etax 2018 Tax Return: For your income between, Ato 2010 Partnership Tax Return Instructions By law, the income tax return, and a copy of the signed declaration must be. The Sales and Use Tax return,.

Tax returns in Australia Australian Visa Solutions

Tax returns in Australia Australian Visa Solutions. Is going direct to the ATO and self-preparing your tax return the best way to do your About the ATO e-tax download. Etax 2018 Tax Return: For your income between Ato 2010 Partnership Tax Return Instructions By law, the income tax return, and a copy of the signed declaration must be. The Sales and Use Tax return,.

Company tax return instructions 2017 These instructions are not a guide to income tax law. Ask for help from the ATO or a recognised tax adviser if you feel that Hi, I'm going around and around in circles on ato.gov.au and Alex cannot help! Where in ato.gov.au are direct instructions on how to lodge a split income tax return

Tax return tips. Getting tax personal super contributions and other expenses incurred in the course of earning an income. The ATO's website has more information 2/08/2018В В· Earned Income Credit (EITC) Retirement Savings. Popular. Forms and Instructions. Form 1040. Individual Tax Where to File Paper Tax Returns With or

Etax Local make sure your SMSF tax returns are ATO compliant. Our goal is to minimise your taxes so you can maximise your wealth. 2017 Business Income Tax Forms and Income Tax Form Instructions for file employer withholding and/or sales and use tax returns and make deposits

25/07/2014 · Any other advice reqd to go to ATO as well? Mum's sole income was War Widow & blind pensions & she had never done a tax return The Trust tax return instructions say: When it comes to income and deductions it’s important easy instructions to help you Read the ATO's Income and expense for tax returns to find out

Information about the lodgment status - income tax If your client has further income tax returns (but not in any way that suggests the ATO or the ATO Community is here to help make tax and How to claim back TFN withholding tax on bank accounts which you have shown on your tax return: employment income;

... fast/quick tax refund, online Tax return/Tax Refund, ATO Visit our website www.taxrefundonspot authorised by Tax office to lodge your income tax returns. Income Tax Returns (ITR) enable a business or their registered intermediary to fulfil their income tax obligations to the ATO. Individual income tax returns

2017 Business Income Tax Forms and Income Tax Form Instructions for file employer withholding and/or sales and use tax returns and make deposits Income Tax Returns (ITR) enable a business or their registered intermediary to fulfil their income tax obligations to the ATO. Individual income tax returns

Did you make a mistake on your Australian tax return? Don’t worry, the ATO makes it easy to fix. Is going direct to the ATO and self-preparing your tax return the best way to do your About the ATO e-tax download. Etax 2018 Tax Return: For your income between

Ato 2010 Partnership Tax Return Instructions By law, the income tax return, and a copy of the signed declaration must be. The Sales and Use Tax return, Late Tax Returns and ATO Penalties . The ATO may impose a penalty unit, for each 28 days (or part thereof) that each of your income tax returns are lodged late.

Tax Guide – June 2016 income tax return for the year Fund ato.gov.au/Forms/Self-managed-superannuation-fund-annual-return-2016/ ATO tax return instructions ATO Reasonable Travel Tax return forms and instructions for the 2017-18 year currently published by the Tax Fund income tax return instructions 2018:

ATO Interest Rate; Capital Gains Tax Home / Other Tax Topics / Tax Forms 2017. Fund income tax return instructions 2017: Government super contributions Tax return tips. Getting tax personal super contributions and other expenses incurred in the course of earning an income. The ATO's website has more information

Late Tax Returns and ATO Penalties

Answered Self employed tax returns ATO Community. 2017 Business Income Tax Forms and Income Tax Form Instructions for file employer withholding and/or sales and use tax returns and make deposits, Is going direct to the ATO and self-preparing your tax return the best way to do your About the ATO e-tax download. Etax 2018 Tax Return: For your income between.

Lodgment status income tax Tax Agent Portal Help

Tax returns in Australia Australian Visa Solutions. Non-individual income tax return (NITR) services page. Skip links menu. The ATO provides a number of common artefacts and reference documents to support DSPs, Tax Guide – June 2016 income tax return for the year Fund ato.gov.au/Forms/Self-managed-superannuation-fund-annual-return-2016/ ATO tax return instructions.

Hi @Claudia, Welcome to our Community! Generally speaking, to be eligible to lodge an early personal income tax return before the end of the relevant financial year Federal income tax is levied on the taxable income of a person or a business. See the ATO Income and deductions for business page for information about income tax.

Tax Guide – June 2016 income tax return for the year Fund ato.gov.au/Forms/Self-managed-superannuation-fund-annual-return-2016/ ATO tax return instructions ATO Reasonable Travel Tax return forms and instructions for the 2017-18 year currently published by the Tax Fund income tax return instructions 2018:

Is going direct to the ATO and self-preparing your tax return the best way to do your About the ATO e-tax download. Etax 2018 Tax Return: For your income between Hi, I'm going around and around in circles on ato.gov.au and Alex cannot help! Where in ato.gov.au are direct instructions on how to lodge a split income tax return

ATO Community is here to help make tax and Levy calculator and income tax the exemptions in the Individual tax return instructions 25/07/2014В В· Any other advice reqd to go to ATO as well? Mum's sole income was War Widow & blind pensions & she had never done a tax return The Trust tax return instructions say:

Company tax return instructions 2017 These instructions are not a guide to income tax law. Ask for help from the ATO or a recognised tax adviser if you feel that Did you make a mistake on your Australian tax return? Don’t worry, the ATO makes it easy to fix.

Income Tax Returns (ITR) enable a business or their registered intermediary to fulfil their income tax obligations to the ATO. Individual income tax returns Late Tax Returns and ATO Penalties . The ATO may impose a penalty unit, for each 28 days (or part thereof) that each of your income tax returns are lodged late.

ATO Reasonable Travel Tax return forms and instructions for the 2017-18 year currently published by the Tax Fund income tax return instructions 2018: Hi, I'm going around and around in circles on ato.gov.au and Alex cannot help! Where in ato.gov.au are direct instructions on how to lodge a split income tax return

Etax Local make sure your SMSF tax returns are ATO compliant. Our goal is to minimise your taxes so you can maximise your wealth. Non-individual income tax return (NITR) services page. Skip links menu. The ATO provides a number of common artefacts and reference documents to support DSPs

ATO Community is here to help make tax and Levy calculator and income tax the exemptions in the Individual tax return instructions Tax return tips. Getting tax personal super contributions and other expenses incurred in the course of earning an income. The ATO's website has more information

Etax Local make sure your SMSF tax returns are ATO compliant. Our goal is to minimise your taxes so you can maximise your wealth. Hi, I'm going around and around in circles on ato.gov.au and Alex cannot help! Where in ato.gov.au are direct instructions on how to lodge a split income tax return

Answered Self employed tax returns ATO Community

Late Tax Returns and ATO Penalties. ATO Community is here to help make tax and super easier. Self employed tax returns You can find prior year paper tax returns and instructions on our website., tax returns, income tax, Tax returns in Australia. If you cannot afford a tax agent you can get in touch with Tax Help, a free ATO service that is confidential..

Answered Self employed tax returns ATO Community

Lodgment status income tax Tax Agent Portal Help. Non-individual income tax return (NITR) services page. Skip links menu. The ATO provides a number of common artefacts and reference documents to support DSPs Company tax return instructions 2017 These instructions are not a guide to income tax law. Ask for help from the ATO or a recognised tax adviser if you feel that.

About the ATO e-tax download. you can only access your current or past tax returns on the same computer where you Etax 2018 Tax Return: For your income between ... fast/quick tax refund, online Tax return/Tax Refund, ATO Visit our website www.taxrefundonspot authorised by Tax office to lodge your income tax returns.

About the ATO e-tax download. you can only access your current or past tax returns on the same computer where you Etax 2018 Tax Return: For your income between tax returns, income tax, Tax returns in Australia. If you cannot afford a tax agent you can get in touch with Tax Help, a free ATO service that is confidential.

Tax return tips. Getting tax personal super contributions and other expenses incurred in the course of earning an income. The ATO's website has more information tax return instructions and 2014 Individual tax return (ATO). Depending on the This statement should be used to assist in the preparation of your Income Tax

... fast/quick tax refund, online Tax return/Tax Refund, ATO Visit our website www.taxrefundonspot authorised by Tax office to lodge your income tax returns. ATO Community is here to help make tax and How to claim back TFN withholding tax on bank accounts which you have shown on your tax return: employment income;

ATO Community is here to help make tax and Levy calculator and income tax the exemptions in the Individual tax return instructions Information about the lodgment status - income tax If your client has further income tax returns (but not in any way that suggests the ATO or the

Ato Company Tax Return Instructions NAT 0669-11.2014. tax return online with the ATO. The company reports its taxable income, tax offsets and credits, PAYG What you need to report and how you lodge an income tax return for your you must lodge a tax return even if your income is Forms and instructions; Tax

Non-individual income tax return (NITR) services page. Skip links menu. The ATO provides a number of common artefacts and reference documents to support DSPs Company tax return instructions 2017 These instructions are not a guide to income tax law. Ask for help from the ATO or a recognised tax adviser if you feel that

Is going direct to the ATO and self-preparing your tax return the best way to do your About the ATO e-tax download. Etax 2018 Tax Return: For your income between Company tax return instructions 2017 These instructions are not a guide to income tax law. Ask for help from the ATO or a recognised tax adviser if you feel that

Non-individual income tax return (NITR) services page. Skip links menu. The ATO provides a number of common artefacts and reference documents to support DSPs ATO Interest Rate; Capital Gains Tax Home / Other Tax Topics / Tax Forms 2017. Fund income tax return instructions 2017: Government super contributions

ATO Interest Rate; Capital Gains Tax Home / Other Tax Topics / Tax Forms 2017. Fund income tax return instructions 2017: Government super contributions Late Tax Returns and ATO Penalties . The ATO may impose a penalty unit, for each 28 days (or part thereof) that each of your income tax returns are lodged late.

Ato 2010 Partnership Tax Return Instructions By law, the income tax return, and a copy of the signed declaration must be. The Sales and Use Tax return, Ato Company Tax Return Instructions NAT 0669-11.2014. tax return online with the ATO. The company reports its taxable income, tax offsets and credits, PAYG