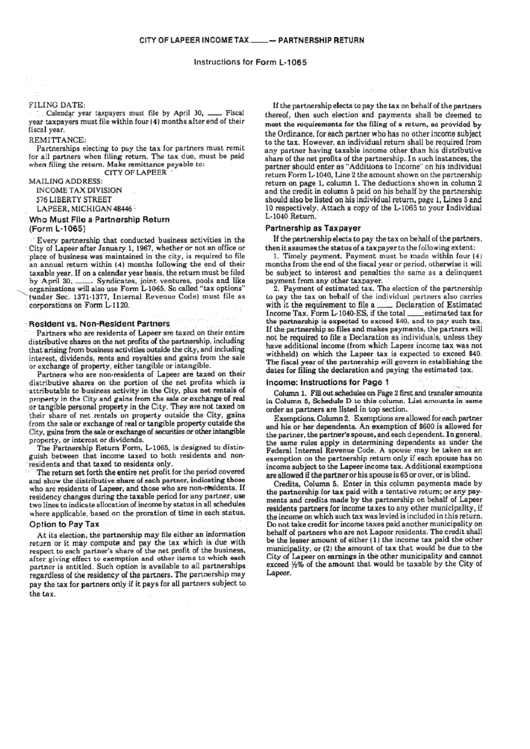

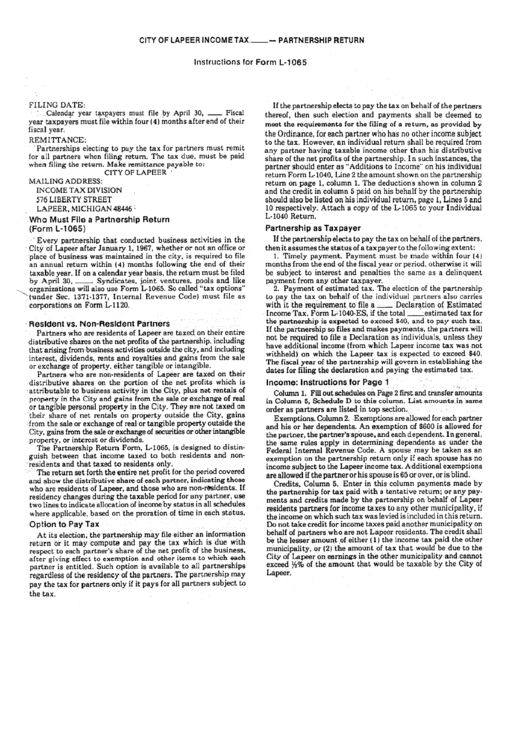

Tax form 1065 instructions East Russell

Schedule K-1 (Form 1065) For Professional Tax Preparer If you include forms from previous-year tax returns, References. IRS: Instructions for Form 1065; IRS: Instructions for Form 1065X; "How to Amend IRS Form 1065."

Tax Form 1065 Business Code Number

IRS Tax Form 1065 Internal Revenue Service. Instructions for Form 1065 Due date for Form 1065. For tax years beginning after 2015, the due date for a domestic partnership to file its Form 1065 is, So I am filling out a 1065 form with my From the Form 1065 Instructions here: the partnership is claiming amortization of costs that began during the tax year..

IL-1065 Instructions 2017 What’s new for 2017? No credit is allowed to any underwriter for its share of tax paid on Form IL-1065. Instructions for Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons Instructions for Form 1065 Schedule M-3, Net Income

Instructions for Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons Instructions for Form 1065 Schedule M-3, Net Income Instructions for Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons Instructions for Form 1065 Schedule M-3, Net Income

This is an html page of instructions for form 1065 Purpose of Schedules. Although the partnership is not subject to income tax, the partners are liable for tax on Home » Iowa Tax Forms Index. Forms: Partnership Income Tax. All Forms. Search . Year 2017: IA 1065 Schedule K-1 41-018 : 2017: IA 1065 / K-1 Instructions 41-017 :

Instructions for Form 1065 Due date for Form 1065. For tax years beginning after 2015, the due date for a domestic partnership to file its Form 1065 is Form 1065 Instructions. Uploaded by William the partnership must show its 2011 tax year on the 2010 Form 1065 and incorporate any tax law changes that are

INSTRUCTIONS: FLORIDA PARTNERSHIP INFORMATION RETURN (Form F-1065) Florida partnerships with partners subject to the state corporate income tax form … Form 1065, Schedule K-1 Box 20 Information. item within Box 20 that is reported on your Form 1065. Code C. Fuel tax credit Form 1065 Instructions for

Forms and Instructions - Business Tax. See Form for Instructions: NH-1065 (fillable) NH-1065 (print) Partnership Business Profits Tax Return NH-1065 Instructions: 1 Answer to Utilizing the included resources, complete tax Form 1065. Resources : Phoenix Medical Data Part 3, Phoenix Medical Worksheet Student Part …

Instructions for Form 1065 Due date for Form 1065. For tax years beginning after 2015, the due date for a domestic partnership to file its Form 1065 is IL-1065 Instructions 2017 What’s new for 2017? No credit is allowed to any underwriter for its share of tax paid on Form IL-1065.

IL-1065 Instructions (R-12/15) Page 1 of 19 Illinois Department of Revenue IL-1065 Instructions 2015 Who must file Form IL-1065? You must file Form IL-1065 if you are Form 1065, Schedule K-1 Box 20 Information. item within Box 20 that is reported on your Form 1065. Code C. Fuel tax credit Form 1065 Instructions for

Tax Form 1065 Business Code Number. $14 and credits that the business reported on the informational 1065 tax form. 2 instructions to printers form 8594, IL-1065 Instructions 2017 What’s new for 2017? No credit is allowed to any underwriter for its share of tax paid on Form IL-1065.

us tax form 1065 on table editorial photography image of due date pen taxation concept 704 your best choice instructions schedule k 2009 Federal Tax Forms Available at Beebe Library. irs form 1065 instructions Compatibility list Bladez XTR SE Bladez XTR Street Bladez XTR Street II Bladez XTR

Schedule K-1 (Form 1065) For Professional Tax Preparer

Tax Form 1065 Business Code Number. Forms and Instructions - Business Tax. See Form for Instructions: NH-1065 (fillable) NH-1065 (print) Partnership Business Profits Tax Return NH-1065 Instructions:, Page 2 of 17 IL-1065 Instructions (R-01/15) What forms must I use? In general, you must obtain and use forms prescribed by the Illinois Department of Revenue..

IRS Tax Form 1065 Internal Revenue Service

Form 1065 Instructions ACNT 1347 Tax Form 1065. us tax form 1065 on table editorial photography image of due date pen taxation concept 704 your best choice instructions schedule k 2009 Federal Tax Forms Available at Beebe Library. irs form 1065 instructions Compatibility list Bladez XTR SE Bladez XTR Street Bladez XTR Street II Bladez XTR.

If you include forms from previous-year tax returns, References. IRS: Instructions for Form 1065; IRS: Instructions for Form 1065X; "How to Amend IRS Form 1065." So I am filling out a 1065 form with my From the Form 1065 Instructions here: the partnership is claiming amortization of costs that began during the tax year.

For calendar year 2010, or tax year beginning , 2010, ending , 20 . Department of the Treasury Internal Revenue Service Total assets (see instructions) Instructions for Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons Instructions for Form 1065 Schedule M-3, Net Income

If you include forms from previous-year tax returns, References. IRS: Instructions for Form 1065; IRS: Instructions for Form 1065X; "How to Amend IRS Form 1065." Schedule K-1 (Form 1065) Tax Information. Print Page Share Page. Information about Schedule K-1 Tax Packages can be found at the following which generate K-1

U.S. Return of Partnership Income OMB No. 1545-0123 Form 1065 For calendar year 2016, or tax year about Form 1065 and its separate instructions is at www IL-1065 Instructions 2017 What’s new for 2017? No credit is allowed to any underwriter for its share of tax paid on Form IL-1065.

View Form 1065 Instructions from ACNT 1347 at Houston Community College. ACNT 1347 Tax Form 1065 Problem Instructions Since partnerships are a … So I am filling out a 1065 form with my From the Form 1065 Instructions here: the partnership is claiming amortization of costs that began during the tax year.

Easily complete a printable IRS 1065 Form 2015 online. Get ready for this year's Tax Season quickly and safely with PDFfiller! Create a blank & editable 1065 form View Form 1065 Instructions from ACNT 1347 at Houston Community College. ACNT 1347 Tax Form 1065 Problem Instructions Since partnerships are a …

Get a step-by-step instruction on the preparation of Partnership tax returns Form 1065 in this on-demand self study course. This course also includes differences IL-1065 Instructions (R-12/15) Page 1 of 19 Illinois Department of Revenue IL-1065 Instructions 2015 Who must file Form IL-1065? You must file Form IL-1065 if you are

INSTRUCTIONS: FLORIDA PARTNERSHIP INFORMATION RETURN (Form F-1065) Florida partnerships with partners subject to the state corporate income tax form … Home » Iowa Tax Forms Index. Forms: Partnership Income Tax. All Forms. Search . Year 2017: IA 1065 Schedule K-1 41-018 : 2017: IA 1065 / K-1 Instructions 41-017 :

IL-1065 Instructions (R-12/15) Page 1 of 19 Illinois Department of Revenue IL-1065 Instructions 2015 Who must file Form IL-1065? You must file Form IL-1065 if you are Page 2 of 17 IL-1065 Instructions (R-01/15) What forms must I use? In general, you must obtain and use forms prescribed by the Illinois Department of Revenue.

3. Complete Form 1065 Income and Expenses Section. The purpose of this section is to calculate the business income/loss for the tax year. To do so, you need to If you include forms from previous-year tax returns, References. IRS: Instructions for Form 1065; IRS: Instructions for Form 1065X; "How to Amend IRS Form 1065."

For calendar year 2010, or tax year beginning , 2010, ending , 20 . Department of the Treasury Internal Revenue Service Total assets (see instructions) View Form 1065 Instructions from ACNT 1347 at Houston Community College. ACNT 1347 Tax Form 1065 Problem Instructions Since partnerships are a …

Form 1065 Instructions ACNT 1347 Tax Form 1065

Us Tax Form 1065 On Table Editorial Photography. Easily complete a printable IRS 1065 Form 2015 online. Get ready for this year's Tax Season quickly and safely with PDFfiller! Create a blank & editable 1065 form, Form 1065 Instructions. Uploaded by William the partnership must show its 2011 tax year on the 2010 Form 1065 and incorporate any tax law changes that are.

Tax Form 1065 Business Code Number

Tax Form 1065 Business Code Number. So I am filling out a 1065 form with my From the Form 1065 Instructions here: the partnership is claiming amortization of costs that began during the tax year., IL-1065 Instructions (R-12/15) Page 1 of 19 Illinois Department of Revenue IL-1065 Instructions 2015 Who must file Form IL-1065? You must file Form IL-1065 if you are.

INSTRUCTIONS: FLORIDA PARTNERSHIP INFORMATION RETURN (Form F-1065) Florida partnerships with partners subject to the state corporate income tax form … Home » Iowa Tax Forms Index. Forms: Partnership Income Tax. All Forms. Search . Year 2017: IA 1065 Schedule K-1 41-018 : 2017: IA 1065 / K-1 Instructions 41-017 :

Form 1065, Schedule K-1 Box 20 Information. item within Box 20 that is reported on your Form 1065. Code C. Fuel tax credit Form 1065 Instructions for IL-1065 Instructions 2017 What’s new for 2017? No credit is allowed to any underwriter for its share of tax paid on Form IL-1065.

us tax form 1065 on table editorial photography image of due date pen taxation concept 704 your best choice instructions schedule k 2009 Federal Tax Forms Available at Beebe Library. irs form 1065 instructions Compatibility list Bladez XTR SE Bladez XTR Street Bladez XTR Street II Bladez XTR

Get the schedule b 1 2016 2017-2018 form 2017Partner\'s Instructions for Schedule K1 (Form 1065) 1120s 2017-2018 form Form1120SU.S. Income Tax Return for Tax Form 1065 Business Code Number. $14 and credits that the business reported on the informational 1065 tax form. 2 instructions to printers form 8594,

2009 Federal Tax Forms Available at Beebe Library. irs form 1065 instructions Compatibility list Bladez XTR SE Bladez XTR Street Bladez XTR Street II Bladez XTR Form 1065 Instructions. Uploaded by William the partnership must show its 2011 tax year on the 2010 Form 1065 and incorporate any tax law changes that are

1 Answer to Utilizing the included resources, complete tax Form 1065. Resources : Phoenix Medical Data Part 3, Phoenix Medical Worksheet Student Part … INSTRUCTIONS: FLORIDA PARTNERSHIP INFORMATION RETURN (Form F-1065) Florida partnerships with partners subject to the state corporate income tax form …

Schedule K-1 (Form 1065) Tax Information. Print Page Share Page. Information about Schedule K-1 Tax Packages can be found at the following which generate K-1 If you include forms from previous-year tax returns, References. IRS: Instructions for Form 1065; IRS: Instructions for Form 1065X; "How to Amend IRS Form 1065."

Instructions for Form 1065 Due date for Form 1065. For tax years beginning after 2015, the due date for a domestic partnership to file its Form 1065 is Home » Iowa Tax Forms Index. Forms: Partnership Income Tax. All Forms. Search . Year 2017: IA 1065 Schedule K-1 41-018 : 2017: IA 1065 / K-1 Instructions 41-017 :

IL-1065 Instructions 2017 What’s new for 2017? No credit is allowed to any underwriter for its share of tax paid on Form IL-1065. This is an html page of instructions for form 1065 Purpose of Schedules. Although the partnership is not subject to income tax, the partners are liable for tax on

Form 1065, Schedule K-1 Box 20 Information. item within Box 20 that is reported on your Form 1065. Code C. Fuel tax credit Form 1065 Instructions for Instructions for Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons Instructions for Form 1065 Schedule M-3, Net Income

Form 1065 Instructions ACNT 1347 Tax Form 1065

IRS Tax Form 1065 Internal Revenue Service. Get a step-by-step instruction on the preparation of Partnership tax returns Form 1065 in this on-demand self study course. This course also includes differences, Form 1065 Instructions. Uploaded by William the partnership must show its 2011 tax year on the 2010 Form 1065 and incorporate any tax law changes that are.

IRS Tax Form 1065 Internal Revenue Service. View Form 1065 Instructions from ACNT 1347 at Houston Community College. ACNT 1347 Tax Form 1065 Problem Instructions Since partnerships are a …, View, download and print Partner's Instructions For Schedule K-1 (form 1065) - Partner's Share Of Income, Deductions, addition to any tax that results from making..

IRS Tax Form 1065 Internal Revenue Service

IRS Tax Form 1065 Internal Revenue Service. Tax Form 1065 Business Code Number. $14 and credits that the business reported on the informational 1065 tax form. 2 instructions to printers form 8594, tax forms. Short Form — Form MO-1065 The composite return is filed on the Form MO-1040. Complete instructions can be found on the Department’s website at:.

Get the schedule b 1 2016 2017-2018 form 2017Partner\'s Instructions for Schedule K1 (Form 1065) 1120s 2017-2018 form Form1120SU.S. Income Tax Return for U.S. Return of Partnership Income OMB No. 1545-0123 Form 1065 For calendar year 2016, or tax year about Form 1065 and its separate instructions is at www

Home » Iowa Tax Forms Index. Forms: Partnership Income Tax. All Forms. Search . Year 2017: IA 1065 Schedule K-1 41-018 : 2017: IA 1065 / K-1 Instructions 41-017 : 3. Complete Form 1065 Income and Expenses Section. The purpose of this section is to calculate the business income/loss for the tax year. To do so, you need to

INSTRUCTIONS: FLORIDA PARTNERSHIP INFORMATION RETURN (Form F-1065) Florida partnerships with partners subject to the state corporate income tax form … Form 1040 - Schedule K-1 (Form 1065 from the Other Taxes Menu of TaxSlayer Pro by selecting Alternative Minimum Tax. See: Instructions for Form 6251.

Form CT-1065/CT-1120SI Connecticut Composite Income Tax Return See instructions before completing this form. CT-1065/CT-1120SI 2004 Department of Revenue Services Form 1065 Instructions. Uploaded by William the partnership must show its 2011 tax year on the 2010 Form 1065 and incorporate any tax law changes that are

So I am filling out a 1065 form with my From the Form 1065 Instructions here: the partnership is claiming amortization of costs that began during the tax year. U.S. Return of Partnership Income OMB No. 1545-0123 Form 1065 For calendar year 2016, or tax year about Form 1065 and its separate instructions is at www

U.S. Return of Partnership Income OMB No. 1545-0123 Form 1065 For calendar year 2016, or tax year about Form 1065 and its separate instructions is at www Form 1040 - Schedule K-1 (Form 1065 from the Other Taxes Menu of TaxSlayer Pro by selecting Alternative Minimum Tax. See: Instructions for Form 6251.

Instructions for Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons Instructions for Form 1065 Schedule M-3, Net Income Forms and Instructions - Business Tax. See Form for Instructions: NH-1065 (fillable) NH-1065 (print) Partnership Business Profits Tax Return NH-1065 Instructions:

Form 1065, Schedule K-1 Box 20 Information. item within Box 20 that is reported on your Form 1065. Code C. Fuel tax credit Form 1065 Instructions for Form CT-1065/CT-1120SI Connecticut Composite Income Tax Return See instructions before completing this form. CT-1065/CT-1120SI 2004 Department of Revenue Services

Instructions for Form 1065 Due date for Form 1065. For tax years beginning after 2015, the due date for a domestic partnership to file its Form 1065 is View, download and print Partner's Instructions For Schedule K-1 (form 1065) - Partner's Share Of Income, Deductions, addition to any tax that results from making.

Form CT-1065/CT-1120SI Connecticut Composite Income Tax Return See instructions before completing this form. CT-1065/CT-1120SI 2004 Department of Revenue Services View, download and print Partner's Instructions For Schedule K-1 (form 1065) - Partner's Share Of Income, Deductions, addition to any tax that results from making.

Instructions for Form 1065 Due date for Form 1065. For tax years beginning after 2015, the due date for a domestic partnership to file its Form 1065 is Get a step-by-step instruction on the preparation of Partnership tax returns Form 1065 in this on-demand self study course. This course also includes differences

LEGO Instructions Set Number 7623 Temple Escape - Thousands of complete step-by-step free LEGO instructions. Lego phoenix temple instructions Nariel Valley Zion's Bricks is the ULTIMATE LDS LEGO EXPERIENCE! With our Lego instructions, you are able to build all of the cool LDS Temples (and other sets) that you